Save Money And Save The Environment

Check out our Energy Guides for everything from Business to Home.

Teho has been featured in multiple newspapers, magazines and online media.

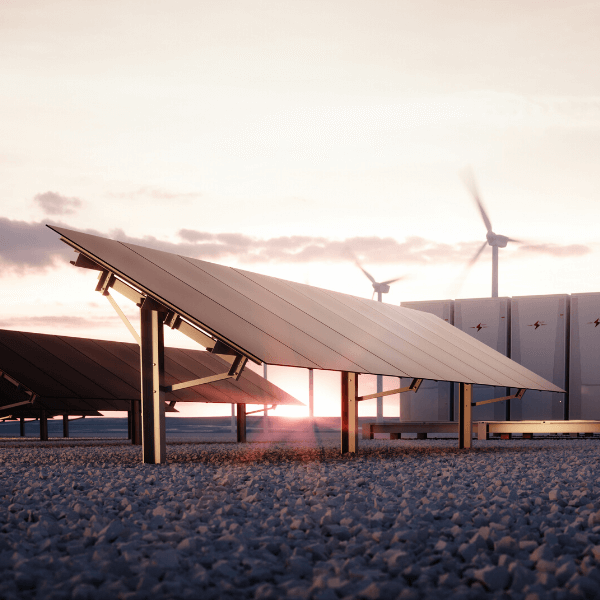

From Residential Installations to Commercial Powerhouses

Save energy at your own home or business.

Don't pay too much for your power bill. Compare today!

We can help you save thousands on your next EV or Hybrid.

Offset your carbon emissions today. Business and Individuals.

Know what is using up your energy every single day.

Teho loves Solar Batteries. We help Australians everyday take more control of their energy, use more of their solar and become even more independent from the grid. Solar Batteries like Tesla Powerwall can even keep the lights on in a black out!

We have put together everything you need to know about Solar Power. From the impact on the environment to the impact on your power bills.

Teho is where Australian’s save time and money as they make the switch Renewable energy. We have the best team in the business and that means you get the best energy solutions saving your money and reducing your reliance on the grid.

Automated page speed optimizations for fast site performance